When perpetual inventories are maintained or when the retail inventory method is used, the inventory on hand may be closely approximated at any time without the necessity of a physical count. In the absence of these devices, the inventory may be estimated by the gross profit method, which utilizes an estimate of the gross profit realized on sales during the period.

If the rate of gross profit on sales is known, the dollar amount of sales for a period can be divided into its two components: (1) gross profit and (2) cost of merchandise sold. The latter may then be deducted from the cost of merchandise available for sale to yield the estimated inventory of merchandise on hand.

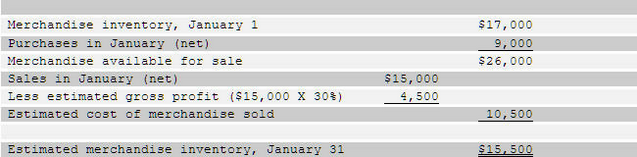

To illustrate this method, assume that the inventory on January I is $17,000, that net purchases during the month amount to $9,000, that net sales during the month amount to $15,000, and finally that gross profit is estimated to be 30% of net sales. The inventory on January 31 may be estimated as shown below.

The estimate of the rate of gross profit is ordinarily based on the actual rate for the preceding year, adjusted for any known changes in markups during the current period. Inventories estimated in this manner are useful in preparing interim statements. The method may also be employed in establishing an estimate of the cost of merchandise destroyed by fire.

[Tab.1r]

. . .