The term inventories is used to designate merchandise held for sale in the normal course of business and also materials in the process of production or held for such use. This discussion is devoted to problems arising in the determination of the inventory of merchandise purchased for resale, commonly called merchandise inventory. Inventories of raw materials and partially processed materials of a manufacturing enterprise are not considered here.

Merchandise is one of the most active elements in the operation of wholesale and retail businesses, being continuously purchased and sold. The sale of merchandise provides the principal source of revenue for such enterprises. In determining net income, the cost of merchandise sold is the largest deduction from sales; in fact, it is customarily larger than all other deductions combined. In addition, a substantial portion of a merchandising firm's resources is invested in inventory; it is frequently the largest of the current assets.

Inventory determination plays an important role in matching expired costs with revenues of the period. The total cost of merchandise available for sale during a period of time must be divided into two elements at the end of the period. The cost of the merchandise determined to be in the inventory will appear on the balance sheet as a current asset. The other element, which is the cost of the merchandise sold, will be reported on the income statement as a deduction from net sales to yield gross profit on sales. An error in the determination of the inventory figure at the end of the period will cause an equal misstatement of gross profit and net income in the income statement, and the amount reported for both assets and capital in the balance sheet will be incorrect by the same amount.

The effects of understatements and overstatements of merchandise inventory at the end of the period are demonstrated below by three sets of extremely condensed income statements and balance sheets. The first set of statements is based on a correct inventory determination, in the second set of statements the inventory has been understated by $8,000, and in the third set the inventory has been overstated by $7,000. In each case the merchandise available for sale is assumed to be $140,000.

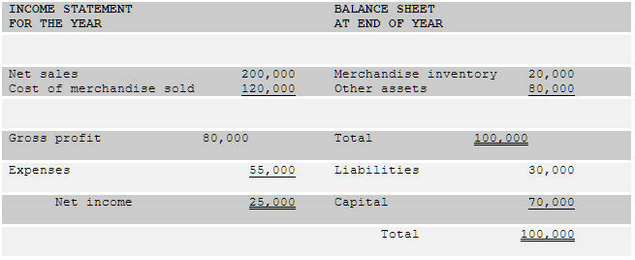

1. Inventory at end of period correctly stated at $20,000.

[Tab.1a]

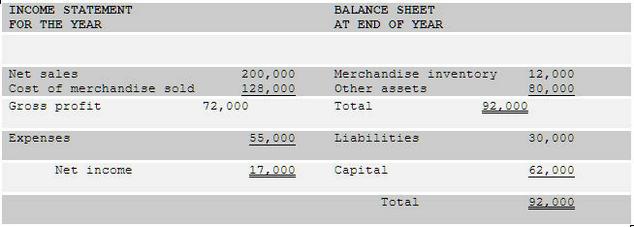

2. Inventory at end of period incorrectly stated at $12,000; understated by $8,000.

[Tab.1b]

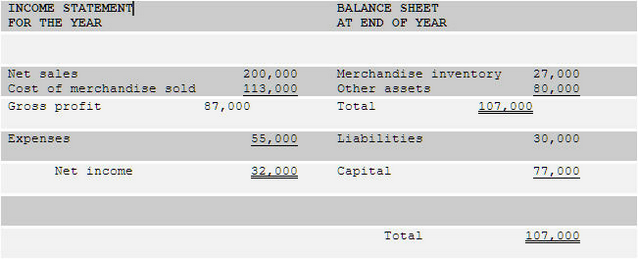

3. Inventory at end of period incorrectly stated at $27,000; overstated by $7,000.

[Tab.1c]

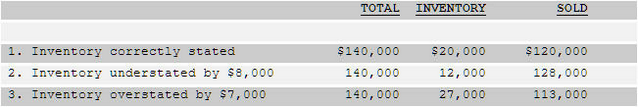

Note that in the illustration the total amount of merchandise cost to be accounted for was constant at $140,000; it was the manner in which the cost was allocated that varied. The variations in allocating the $140,000 of merchandise cost are summarized as follows:

MERCHANDISE AVAILABLE

[Tab.1d]

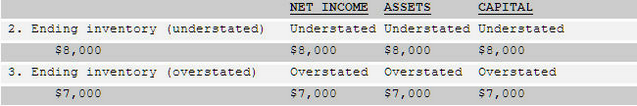

The effect of the erroneous allocations on net income, assets, and capital may also be summarized. Comparison of the amounts reported in financial statements 2 and 3 with the comparable amounts reported in financial statement 1 yields the following:

[Tab.1e]

It should be noted that the inventory at the end of one period becomes the inventory for the beginning of the following period. Thus, if the inventory is incorrectly stated at the end of the period, the net income of that period will be misstated and so will the net income of the following period. The amount of the two misstatements will be equal and in opposite directions. Therefore, the effect on net income of an incorrectly stated inventory, if uncorrected, is limited to the period of the error and the following period. At the end of this following period, assuming no additional errors, both assets and capital will be correctly stated.

Elements of the foregoing analyses are closely related to the various inventory systems and methods presented hereinafter. A thorough understanding of the effect of inventories on the determination of net income, as presented in the foregoing examples, will be helpful.