The cost of merchandise inventory is composed of the purchase price and all expenditures incurred in acquiring such merchandise, including transportation, customs duties, and insurance. The purchase price can be readily determined, as may some of the other costs. Those that are difficult to associate with specific inventory items may be prorated on some equitable basis. Minor costs that are difficult to allocate may be excluded entirely from inventory cost and treated as operating expenses of the period.

If purchases discounts are treated as a deduction from purchases on the income statement, they should also be deducted from the purchase price of items in the inventory. If it is not feasible to determine the exact amount of discount applicable to each inventory item, a pro rata amount of the total discount for the period may be deducted instead. For example, if net purchases and purchases discount for the period amount to $200,000 and $3,000 respectively, the discount represents 1 1/2% of net purchases. If the inventory cost, before considering cash discount, is $30,000, the amount may be reduced by 1 1/2%, or $450, to yield an inventory cost of $29,550.

One of the most significant complications in determining inventory cost arises when identical units of a particular commodity have been acquired at various unit cost prices during the period. When such is the case, it is necessary to determine the unit prices to be associated with the items still on hand. The exact nature of the problem and its relationship to the determination of net income and inventory cost are indicated by the illustration that follows.

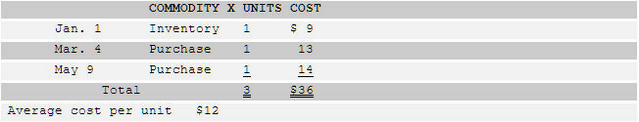

Assume that during the fiscal year three identical units of Commodity X were available for sale to customers, one of which was in the inventory at the beginning of the year. Details as to the dates of purchase and the costs per unit are shown below.

[Tab.1f]

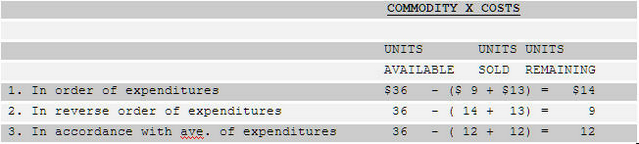

During the period two units of Commodity X were sold, leaving a single unit in the inventory at the end of the period. Information is not available as to which two of the three units were sold and which unit remains. Consequently it becomes necessary to adopt an arbitrary assumption as to the flow of costs of merchandise through the enterprise. The three most common assumptions employed in determining the cost of the merchandise sold are as follows:

| 1. | Cost flow is in the order in which the expenditures were made. |

| 2. | Cost flow is in the reverse order in which the expenditures were made. |

| 3. | Cost flow is an average of the expenditures for merchandise. |

Details of the cost of the two units of Commodity X assumed to be sold and the cost of the one unit remaining, determined in accordance with each of these assumptions, are presented below.

[Tab.1g]

In actual practice it may be possible to identify units with specific expenditures if both the variety of merchandise carried in stock and the volume of sales are relatively small. Ordinarily, however, specific identification procedures are too laborious and costly to justify their use. It is customary, therefore, to adopt one of the three generally accepted costing methods, each of which is also acceptable in determining income subject to the federal income tax.

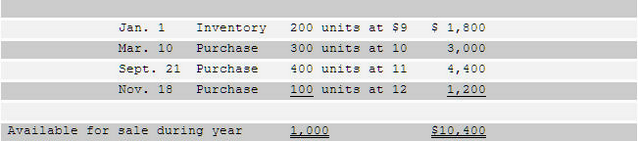

First-in, first-out method. The first-in, first-out (fifo) method of costing inventory is based on the assumption that costs should be charged against revenue in the order in which they were incurred. Hence the inventory remaining is assumed to be composed of the most recent costs. The illustration of the application of this method is based on the following data for a particular commodity:

[Tab.1h]

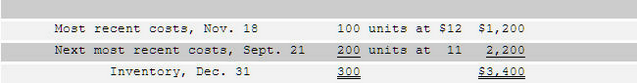

The physical count on December 31 indicates that 300 units of the commodity are on hand. In accordance with the assumption that the inventory is composed of the most recent costs, the cost of the 300 units is determined as follows:

[Tab. 1i]

Deduction of the inventory of $3,400 from the $10,400 of merchandise available for sale yields $7,000 as the cost of merchandise sold, which represents the earliest costs incurred for this commodity.

In most businesses there is a tendency to dispose of commodities in the order of their acquisition. This would be particularly true of perishable merchandise and goods in which style or model changes are frequent. Thus the fifo method is generally in harmony with the physical movement of merchandise in an enterprise. To the extent that this is the case, the fifo method approximates the results that would be obtained by specific identification of costs.

Last-in, first-out method.

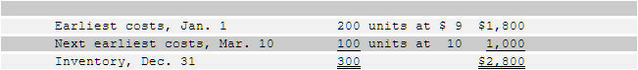

The last-in, first-out (lifo) method is based on the assumption that the most recent costs incurred should be charged against revenue. Hence the inventory remaining is assumed to be composed of the earliest costs. Based on the illustrative data presented in the preceding section, the cost of the inventory is determined in the following manner:

[Tab.1i]

Deduction of the inventory of $2,800 from the $10,400 of merchandise available for sale yields $7,600 as the cost of merchandise sold, which represents the most recent costs incurred for this particular commodity.

The use of the lifo method was originally confined to the relatively rare situations in which the units sold were taken from the most recently acquired stock. Its use has greatly increased during the past few decades, and it is now often employed when it is not in conformity with the physical flow of commodities.

Weighted average method.

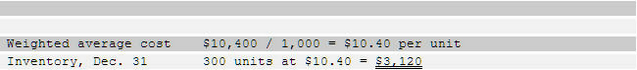

The weighted average method is based on the assumption that costs should be charged against revenue on the basis of an average, taking into consideration the number of units acquired at each price. The same average unit cost is employed in computing the cost of the merchandise remaining in the inventory. The weighted average is determined by dividing the total costs of a commodity available for sale by the total number of units of that commodity available for sale. Assuming the same cost data as in the preceding illustrations, the weighted average cost of the 1,000 units and the cost of the inventory are determined as follows:

[Tab. 1j]

Deduction of the inventory of $3,120 from the $10,400 of merchandise available for sale yields $7,280 as the cost of merchandise sold, which represents the average of the costs incurred for this commodity.

For businesses in which various purchases of identical units of a commodity are mingled, the weighted average method has some relationship to the physical flow of commodities.

Comparison of inventory costing methods.

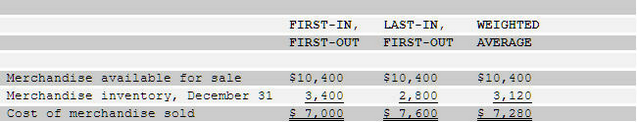

Each of the three alternative methods of costing inventories under the periodic system is based on a different assumption as to the flow of costs. If the cost of commodities and the prices at which they were sold remained perfectly stable, all three methods would yield the same results. Prices do fluctuate, however, and as a consequence the three methods will ordinarily yield different amounts for both (1) the inventory at the end of the period and (2) the cost of the merchandise sold and net income reported for the period. The examples presented in the preceding sections illustrated the effect of rising prices. They may be summarized as follows:

[Tab.1k]

In comparing and evaluating the results obtained in the illustration, it should be borne in mind that both the amount reported as net income and the amount reported as inventory are affected. The method that yields the lowest figure for the cost of merchandise sold will yield the highest figure for gross profit and net income reported on the income statement; it will also yield the highest figure for inventory reported on the balance sheet. Conversely, the method that yields the highest figure for the cost of merchandise sold will yield the lowest figure for gross profit and net income and the lowest figure for inventory.

During periods of consistently rising prices, the use of first-in, first-out yields the highest possible amount of net income. The reason for this effect is that business enterprises tend to increase their selling prices in accordance with market trends, regardless of the fact that merchandise in stock may have been acquired before the price increase. In periods of declining prices the effect is reversed, and the fifo method yields the lowest possible net income. The principal criticism of the fifo method is this tendency to accentuate the effect of inflationary and deflationary trends on reported income. On the other hand, the amount reported for inventory on the balance sheet will closely approximate its current replacement cost.

During periods of consistently rising prices, the use of last-in, first-out yields the lowest possible amount of net income. The reason for this effect is that the cost of the most recently acquired units most nearly approximates the expenditure required to replace the units sold. In periods of declining prices, the effect is reversed and the lifo method yields the highest possible net income. The principal justification for lifo is this tendency to minimize the effect of price trends on reported net income. A criticism of the general use of lifo is its complete lack of relationship to the physical flow of merchandise in most enterprises. The amount reported for inventory on the balance sheet may also be quite far removed from current replacement cost. If there is little change in the physical composition of the inventory from year to year, the inventory cost reported remains nearly constant, regardless of extreme changes in price levels.

The weighted average method of inventory costing is, in a sense, a compromise between fifo and lifo. The effect of price trends is averaged, both in the determination of net income and the determination of inventory cost. For any given series of acquisitions, the weighted average cost will be the same regardless of the direction of price trends. For example, a complete reversal of the sequence of acquisitions and unit costs presented in the illustration would not affect the reported net income or the inventory cost. The time required to assemble the data is likely to be greater for the weighted average method than for the other two methods. The additional expense incurred could be significant if there are numerous purchases of a wide variety of merchandise items.

The foregoing comparisons indicate the importance attached to the selection of the inventory costing method. The method adopted must be consistently followed from year to year, except where there is a valid reason for a change. The effect of any change in method and the reason for the change should be fully disclosed in the financial statements for the fiscal period in which the change occurred.

Throughout the discussion of inventory costing there has been an assumption that the commodities on hand were salable in a normal manner. Because of imperfections, shop wear, style changes or other causes, there may be items that are not salable except at prices below cost. Such merchandise should be valued at estimated selling price less any direct cost of disposition, such as sales commission.