An alternative to valuing inventory at cost is to compare cost with market price and use the lower of the two. It should be borne in mind that regardless of the method used it is first necessary to determine the cost of the inventory. "Market," as used in the phrase lower of cost or market or cost or market, whichever is lower, is interpreted to mean the cost to replace the merchandise on the inventory date. To the extent practicable, the market or replacement price should be based on quantities typically purchased from the usual source of supply. In the discussion that follows, the salebility of the merchandise in a normal manner will be assumed. The valuation of articles that have to be sold at a price below cost would be determined by the method described in the preceding paragraph.

If the replacement price of an item in the inventory is lower than its cost, there is almost certain to be an accompanying decline in the selling price. Recognition of the price decline in valuing the item reduces the gross profit (and net income) for the period in which the decline occurred. There is also an inherent presumption that when the item is sold in the following period at a reduced price, the sale should yield approximately the normal gross profit.

To illustrate, assume that particular merchandise with a unit cost of $70 has sold during the period at $ 1 00, yielding a gross profit of $30 a unit, or 30% of sales. Assume also that there is a single unit of the commodity in the inventory at the end of the year and that meanwhile the replacement price has declined to $63. Under such circumstances it would be reasonable to expect that the selling price would also decline, if indeed it had not already done so. Assuming a reduction in selling price to $90, the gross profit based on replacement cost of $63 would be $27, which is also 30% of selling price.

Accordingly, valuation of the unit in the inventory at $63 reduces net income of the past period by $7 and permits a normal gross profit of $27 to be realized on its sale in the following period. If the unit had been valued at its original cost of $70, the net income determined for the past year would have been $7 greater, and the net income attributable to the sale of the item in the following period would have been $7 less.

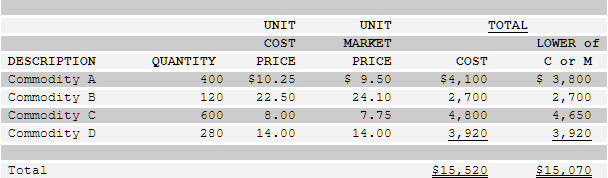

It would be possible to apply the lower of cost or market basis (1) to each item in the inventory, (2) to major classes or categories, or (3) to the inventory as a whole. The first procedure is the one customarily followed in practice, and it is the only one of the three that is acceptable for federal income tax purposes. To illustrate the application of the lower of cost or market to individual items, assume that there are 400 identical units of Commodity A in the inventory, each acquired at a unit cost of $10.25. If at the inventory date the commodity would cost $10.50 to replace, the cost price of $10.25 would be multiplied by 400 to determine the inventory value. On the other hand, if the commodity could be replaced at $9.50 a unit, the replacement price of $9.50 would be used for valuation purposes. The following tabulation illustrates one of the forms that may be followed in assembling inventory data.

Although the column for total cost is not essential, it permits the measurement of the reduction in inventory attributable to market declines. When the amount of the market decline is known ($450 in the illustration), it may be reported as a separate item on the income statement. Otherwise, the market decline will be included in the amount reported as the cost of merchandise sold and will reduce gross profit by a

[Tab.1l]

corresponding amount. In any event, the amount reported as net income will not be affected; it will be the same regardless of whether or not the amount of the market decline is determined and separately stated.

As with the method elected for the determination of inventory cost (fifo, lifo, or weighted average), the method elected for inventory valuation (cost, or lower of cost or market) must be followed consistently from year to year. Both methods of valuation are acceptable in determining income for federal income tax purposes, except that when the last-in, first-out procedure is employed, the inventory must be stated at cost.