The retail inventory method of inventory costing is widely used by retail businesses, particularly department stores. It is employed in connection with the periodic system of inventories and is based on the relationship of the cost of merchandise available for sale to the retail price of the same merchandise. The retail prices of all merchandise acquired are accumulated in supplementary records, and the inventory at retail is determined by deducting sales for the period from the retail price of the goods that were available for sale during the period. The inventory at retail is then converted to cost on the basis of the ratio of the cost of the merchandise available for sale to the selling price of the merchandise available for sale.

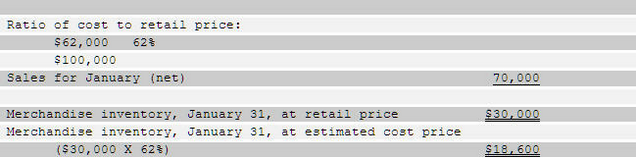

Determination of inventory by the retail method is illustrated below.

There is an inherent assumption in the retail method that the composition or "mix" of the commodities in the ending inventory, in terms of percent of cost to selling price, is comparable to the entire stock of merchandise available for sale. For example, in the illustration above it is unlikely

[Tab.m-n]

that the retail price of every item was composed of exactly 62% cost and 38% gross profit margin. It is assumed, however, that the weighted average of the cost percentages of the merchandise in the inventory ($30,000) is the same as in the merchandise available for sale ($100,000). Where the inventory is composed of different classes of merchandise with significantly different gross profit rates, the cost percentages and the inventory should be developed separately for each section or department.

The use of the retail method does not eliminate the necessity for taking a physical inventory at the end of the year. However, the items are recorded on the inventory sheets at their selling prices instead of their cost prices. The physical inventory at selling price is then converted to cost by applying the ratio of the cost of merchandise available for sale to the selling price of the same merchandise. To illustrate, assume that the data presented in the example above are for an entire fiscal year rather than for the first month of the year only. If the physical inventory taken on December 3 1, priced at retail, totaled $29,000, it would be this amount rather than the $30,000 in the illustration that would be converted to cost.

Accordingly, the inventory at cost would be $17,980 ($29,000 x 62%) instead of $18,600 ($30,000 x 62%).

One of the principal advantages of the retail method is that it provides inventory figures for use in preparing interim statements. Department stores and similar merchandisers customarily determine gross profit and operating income each month but take a physical inventory only once a year. In addition to facilitating frequent income determinations, a comparison of the computed inventory total with the physical inventory total, both at retail prices, will disclose the extent of inventory shortages and the consequent need for corrective measures.